Japanese customers shop online for a number of reasons and for a wide range of products. When shopping online, Japanese consumers buy everything from gifts to groceries, furniture to workout equipment, and everything in between.

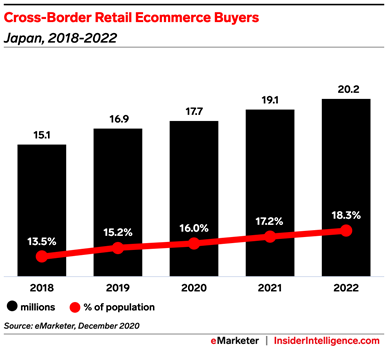

Shopping from international retailers gives them access to products that aren’t generally sold in Japan, as well as more variety and better prices. Japanese online customers are becoming increasingly willing to make purchases from international suppliers. As seen in the graph below, the number of internet buyers making cross-border purchases is increasing.

Japanese Consumer Behaviour Affects Overall Buying

In various areas, Japanese consumers have typically been sluggish to embrace new behaviours, owing primarily to their elderly population. This, however, has shifted considerably in recent years. Traditional Japanese businesses have been pushed to undergo a digital transformation since the majority of employees work from home.

Although Japan has not seen rigorous lockdowns in the same way that Europe or North America have, the many states of emergency and the encouragement of “staying at home” have resulted in an unparalleled increase in internet buying. As a result, more individuals are turning to digital platforms, media, and apps to order food and common products online.

Millions of internet consumers in Japan buy on a regular basis. While this diversity is fantastic and allows all types of brands to succeed in Japan, there are a few trends and statistics to pay attention to:

Clothing Is The #1 Trend In Japan

Nearly half of Japanese shoppers have purchased some kind of clothing in the past year and clothing continues to hold the largest market share in Japanese eCommerce.

Japanese shoppers have a long history with American fashion, and their purchase patterns frequently reflect current trends. Athleisure, a phrase used to describe clothing that can be worn in the gym or out and about, is one of the trends that Japanese consumers are adopting.

Electronics Are Frequently Purchased In Japan

For several years, consumer electronics has been the second-largest eCommerce category in Japan, with a market share of more than 18%.

Surprisingly, domestically purchased electronics are often more expensive for Japanese consumers. For example, brand new smartphones can be acquired for less than $200 from an international seller online; the same phone can cost up to $475 from a Japanese seller. When it comes to purchasing electronics, many Japanese customers resort to the internet.

The Japanese Supplement Market Is Expanding Steadily

In the Japanese eCommerce market, supplements are the best-selling international product. It is also one of the fastest-growing categories, making it ideal for businesses looking to expand into Japan.

Japan is the region’s top user of supplements and nutraceuticals. In 2020, annual income from vitamins and minerals surpassed $2 billion USD. Probiotics, functional meals, and sports nutrition supplements are also popular.

Beauty & Personal Care Is All The Rage

American cosmetics feature more vibrant colours, better coverage, and high-end and premium brands that Japanese consumers want. This covers skincare, foundation, eye shadow, lipstick, highlighter palettes, and any other type of beauty or personal care product.

With an estimated 89.8% internet penetration rate (2021) and the advent of social media, the Japanese youth now have greater access to western beauty information. This has increased interest in and demand for western beauty products.

Sports & Outdoors – A Growing Market

Some significant sporting events have taken place in Tokyo in recent years and will take place in the next years, generating a lot more interest.

Consumption in this category is predicted to exceed $3,833 million in 2021, making it one of Japan’s fastest-growing eCommerce categories. Sports equipment, camping gear, clothing and accessories, and so on are examples of products in this area.

There are no one-size-fit-all solutions when it comes to entering the Japanese market. At Digital Crew, we work with you to determine the best approach, from research, to strategy, to campaign execution, and to on-going management. Get in touch with us